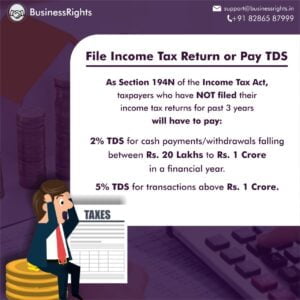

Being a responsible citizen we must pay the right amount of tax on time. The Union Budget 2019 has introduced Section 194N for TDS (Deduction of Tax at Source) on cash withdrawals exceeding Rs. 1 crore to discourage cash payments. But the Budget of the year 2020 has reduced the threshold limit for TDS for above Rs. 20 lakh and below Rs. 1 crore for the taxpayers who have not filed their Income Tax Return for the last three years. Taxpayers like them have to pay 2% of the amount as TDS under Section 194N.

WHAT IS SECTION 194N ??

This Section is introduced for the sum of money or an aggregate of sums that are withdrawn from a particular payer in a financial year. It is applicable in a matter where more than Rs. 1 crore cash is withdrawn. While making payments to any individual in cash the tax will be deducted by the taxpayer’s bank account on the amount that exceeds Rs. 1 crore.

The limit of Rs. 1 crore per financial year is concerning per bank account or post office account and not a taxpayer’s account.

WHY IS SECTION 194N INTRODUCED?

To discourage cash payment and transactions in our country and promote digital economy Section 194N-pay TDS on cash withdrawals above 1 crore is introduced.

WHO COMES UNDER THIS SECTION

Following applicants comes under Section 194N: –

● An Individual

● A Hindu Undivided Family (HUF)

● A Company

● A partnership firm or an LLP

● A local authority

● An Association of people

● Any bank

● A co-operative bank

● A post office

RATE OF TDS UNDER 194N

For cash payments or withdrawals more than Rs. 1 crore in a financial year the taxpayer will have to deduct TDS at a rate of 2%. On the other hand, if the individual has not filed an income tax return for the past three years then TDS will be 2% on cash transaction above Rs. 20 lakh and below or Rs 1 crore and 5% on cash transaction of above Rs. 1 crore.

SALIENT FEATURES OF SECTION 194N

I. People are categorized into two groups: In 2019, Financial Act has introduced Section 194N. So the existing provisions shall carry on to pay a TDS of 2% on cash withdrawal of Rs. 1 crore or above in a financial year. Additionally, it is provided that in cases where people have not filed his ITR(Income Tax Return) for past three assessment years and the time limit to file the return of income has also expired then the threshold limit of Rs. 1 crore is reduced to Rs. 20 lakhs along with following rates:-

a. 2% for cash transaction from Rs. 20 lakh to Rs. 1 crore

b. 5% above Rs. 1 crore

Taxpayers with clean records will continue with the threshold limit of Rs. 1 crore and 2% rate of TDS for cash withdrawal of above Rs. 1 crore.

II. Cash Withdrawal Accounts: For cash withdrawals from a bank account including a cooperative bank and from an account held with the post office this section can be applied.

III. Bank-Wise Threshold Limit: Due to core banking solution implementation by banks the limit of Rs.1 crore shall apply bank-wise and not branch wise under section 194N.

IV. Aggregate from all Accounts: As per the case may be the aggregate account of cash withdrawal from different accounts such as saving account, current, overdraft account, cash credit account, etc of the same person will be aggregated to determine the threshold limit of Rs, 1 crore or Rs. 20 lakh. In other words, this is applicable only if the aggregate amount of cash withdrawal in a financial year is above 1 crore from one or more accounts.

V. TDS shall only be applied on excess cash withdrawal: in this TDS can only be applied on the excess amount of cash withdrawal over Rs. 1 crore or Rs. 20 lakh, depending upon as per the case may be, and not on the entire amount of cash withdrawal.

VI. Exclusion: Except for the government, bank, white-label ATM operators, etc all other applicants such as individuals, HUF, companies, etc who withdrawal excess cash over Rs. 1 crore in a year even if they file the return of income or not exclusion is applicable for them.