‘Self-made man’ or ‘Entrepreneur’, in almost every business sector new startups are flourishing. To give them enough space to blossom our Prime Minister introduced the Startup India Scheme on 16 January 2016. In the race of becoming a successful businessman, this scheme filled the new entrepreneurs with optimism and assumed to be governmental support to their young business.

Startup India Scheme

This is an initiative of the government of India launched by our Prime Minister on 16 January 2016 at Vigyan Bhavan, New Delhi. The Department of Promotion of Industry and Internal Trade has organized it. The policy of the scheme focuses on the following fields:

1. Handholding and Simplification

2. Incentives and finding Support

3. Incubation and Industry-Academia

An additional sector relating to this scheme is to repudiate restrictive state government policies within the sphere of License Raj, Land Permission, Foreign Investment Proposals, and Environmental Clearances. Under this scheme, the I-MADE Program is already launched which helped new Indian entrepreneurs build 10 lakh (1 million) mobile startup apps and provide microfinance, low-interest rate loans to entrepreneurs from low socio-economic backgrounds. The MUDRA BANK has also introduced a scheme called Pradhan Mantri Mudra Yojana.

Eligibility Guide

Today a majority of people do not know about this scheme. They do not know how they can enjoy the benefits of being eligible under this scheme or whether they are at all eligible or not.

To make it easy for you here is a complete guide of eligibility under the Startup India Scheme.

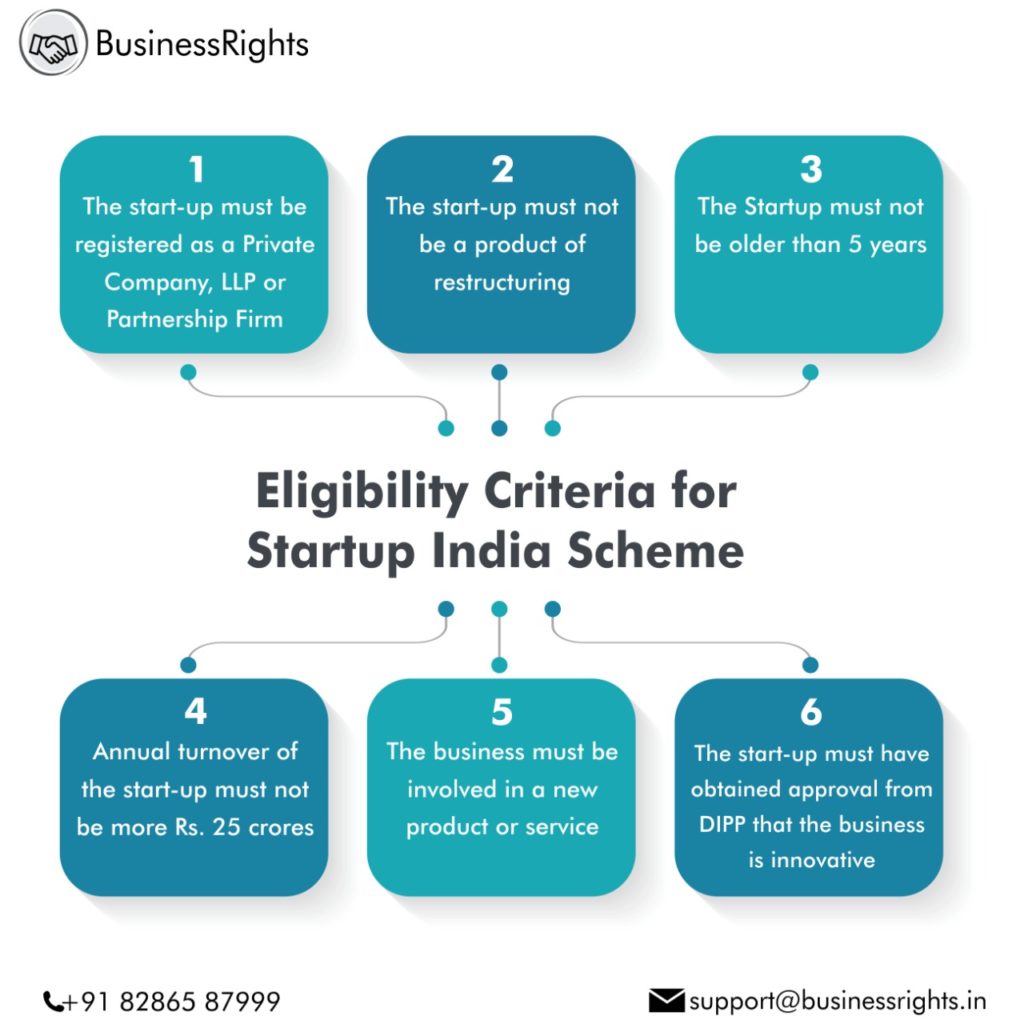

i. The first step towards becoming eligible under the Indian Companies Act, 2013, or a limited liability partnership (LLP) Act 2008 or partnership firm under the Indian Partnership Act, 1932.

ii. Businesses formed out of splitting of an organization into two or more or formed from reconstructing a subsisting business would not be considered eligible under the scheme. The plans and ideas of the startup should be completely your own, different, and effective.

iii. The business startup should not be older than 5 years. Hence all business startups in India that have been registered in the past 5 years from the effective date of the policy, therefore, any business registered after 15 February 2011 are eligible to participate in this government scheme.

iv. Since its registration, the annual turnover should not exceed more than Rs.25 crore to be eligible under this scheme.

v. Only startups passing the following conditions are eligible under the scheme:

1. The startup must develop a new product or service.

2. The startup must be driven by technology or intellectual property and its efforts must result in innovation, development, implementation, or commercialization of a new product, process, or service.

3. The aim of the startup should be the development and commercialization of a new product or service that will create or add value to customers.

4. Products or services do not have the potential for commercialization and in differentiated product or services with limited or not at all incremental value for customers or workflow must not be developed by the startup

5. Every startup must obtain approval from the Inter-Ministerial board set up by the Department of Industrial Policy and Promotion (DIPP).

The benefit of Startup India scheme

Following are the benefits that people can enjoy if their business is eligible under startup India scheme:

1. Financial benefits: – Startup India scheme has made the process of registration of patent cost very easy by providing an 80% refund of the high patent. The speed of the process of patent registration has been increased by this scheme. In addition to these, the fees of the facilitator to obtain the patent is paid by the Government.

2. Income tax benefits: – Under this scheme, you will get equipped with lots of benefits such as you will be provided an income tax exemption from the Government for three years but, only after you obtain a certificate from the Inter-Ministerial Board. Also if you have invested money on particular funds you may get an exemption from capital gains in Income Tax.

3. Registration Benefits: – under the startup India scheme you need not go through complicated steps of registration. It also arranges a single meeting at the startup India Hub to explain the critical steps of registration. It also provides problem solving or single doubt windows for all the participants of the plan.

4. Government Tenders: – Purchasing govern tenders is not an easy task but the startup India scheme provides the business startup with a priority to grab these government Tenders without the prior experience.

5. Huge Networking Opportunities: – Under the Startup India Scheme you are provided with opportunities to meet the various startup stakeholders at a particular place and time by conducting startup fest every year. These fests are conducted at both national and international. it also provides access to many Intellectual Property awareness workshops.