Understanding and managing your tax records is crucial for ensuring compliance and optimizing your tax deductions. One essential document in this regard is Form 26AS, also known as the Tax Credit Statement. It is a consolidated tax statement which can be accessed from the Income Tax Department of India’s official e-filing website. BusinessRights brings you a step-by-step guide to help you view and understand your Form 26AS.

What is Form 26AS?

Form 26AS is a document that provides detailed information about

- Tax deducted on your behalf (TDS)

- Tax collected on your behalf (TCS)

- Advance taxes or self-assessment taxes paid

- Details of refund received during the financial year

- Details of high-value transactions in shares, mutual funds etc.

This form is linked to your PAN (Permanent Account Number) and is an indispensable proof of your tax deductions which must be matched with your TDS certificates received during the financial year.

How to Access Form 26AS?

You can view your Form 26AS through the following methods:

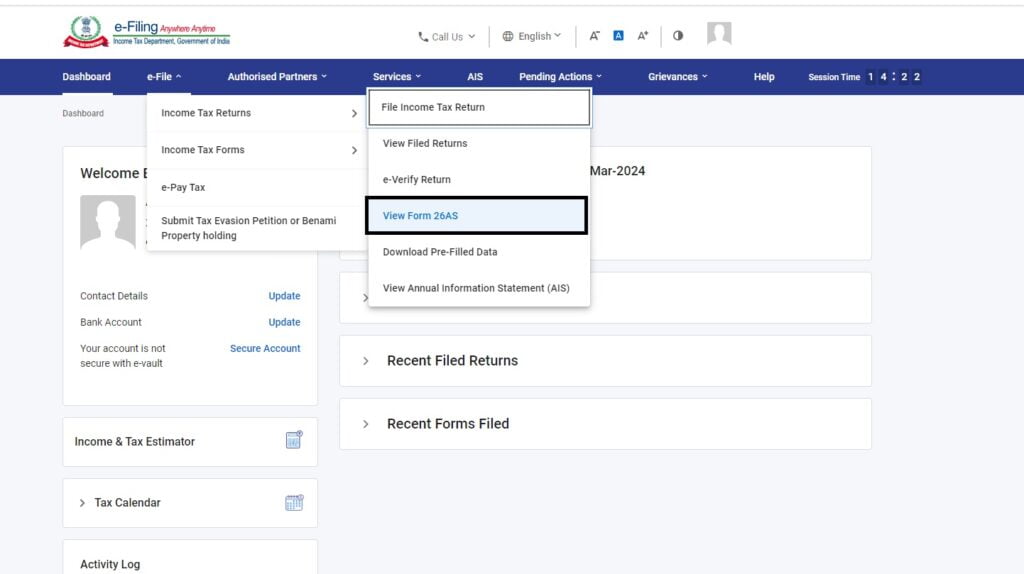

- Through the Income Tax e-filing Website

– Visit the official e-filing website of the Income Tax Department of India

(https://www.incometaxindiaefiling.gov.in/home)

– Log in to the portal using your PAN, which serves as your User ID.

– Navigate to the ‘My Account’ tab and select ‘View Form 26AS (Tax Credit)’ from the dropdown menu.

– Agree to the terms and conditions and click on ‘Confirm’.

– You will be redirected to the TRACES (TDS-CPC) website where you can choose the assessment year and the format in which you want to view the document (HTML, Text, or PDF).

Why Check Form 26AS?

Checking your Form 26AS allows you to:

- Verify the taxes deducted on your behalf and ensure they are correctly credited to your PAN.

- Detect any discrepancies early and take necessary actions, such as contacting the deductor for rectification.

- Compare the TDS entries with the TDS certificates provided by your employer or others.

Conclusion:

Keeping track of your tax payments and deductions through Form 26AS can save you from tax-related hassles and ensure that you are fully aware of your tax liabilities and refunds. At BusinessRights, we understand the importance of these responsibilities and strive to provide you with all the necessary tools and guidance to manage your business effectively.

For more detailed information or personalized tax assistance, feel free to contact our experts at BusinessRights, where we’re committed to empowering your business with the right knowledge.