Any organization that uses its means for the welfare of the society is a non-profit organization. This includes schools, universities, hospitals and religious organizations (NGOs). The most common nonprofit organizations in India are NGO/Section 8 Company.

Section 8 Company Registration

- 1 Name Approval

- 2 DIN & DSC

- Incorporation Certificate

- MOA & AOA

- PAN & TAN

- MSME Registration Certificate

Trust: Trust is the oldest form of a non-profit organization. Trust can be either private or public. It is primarily created for some people.

Section 8 Enterprises: Section 8 Enterprises are governed by the Companies Act 2013. A company under this Section can be created to promote charitable causes related to art, commerce, science, health, etc. These companies enjoy all privileges and are subject to all obligations of limited liability companies.

Register your Trust/Society/Section 8 Company:

t.

The main instrument of the Section 8 Company

For a Section 8 company, the main instrument is a social contract and articles of association (no stamp paper required).

Note: Any company, be it Private Limited, Public Limited or LLP, that works towards the goal of social welfare without the intention of making a profit or dividend can act as a Section 8 company.

Many things distinguish Section 8 company from others. These functions are:

- No one can treat Section 8 companies as small businesses.

- Members of the company cannot claim profit or dividends.

- Members can use any profit or income of the company to promote the business object.

- Companies in Section 8 cannot be included using Form INC-29.

- According to Section 8 (2) of the Companies Act 2013, these companies can enjoy all advantages and are subject to all obligations of other limited liability companies.

- Section 8 companies receive a special permit from the central government.

- Such companies do not need the suffix “Pvt Ltd.” or use “Ltd” with their name.

- The central government regulates these companies. However, central government powers are delegated to the Registrar of Companies (ROC). ROC is also responsible for the area in which the company is based. Therefore, the business registration application must be submitted to the Republic of China.

Checklists/documents required for the inclusion of Section 8 Company

To register your company as Section 8, you should have the following documents in the correct order:

Copy of the PAN (permanent account number) of all directors and shareholders as proof of identity;

A copy of a driver’s license or Aadhaar card or a passport or electoral ID, etc. as proof of address;

Current passport photos of all directors and shareholders;

The electricity bills of the registered office not older than 2 months;

Form DIR-2, approval to work as a director;

Lease agreement if the registered office is registered;

NOC (No-Objection Certificate) from the landlord;

Details of the direction of directors in other companies or LLP, if available.

Forms required for Section 8 NGO registration

To register your company under Section 8 of the Companies Act 2013, you need the following forms:

INC 1 / RUN To reserve the proposed company name

INC 7 Application for company registration as § 8

INC 8 Declaration

INC 9 An affidavit from each subscriber and director

INC 12 Application for a license to operate the Company according to Section 8

INC 13 Memorandum of Association(MOA) of the company

INC 14 Declaration from a CA in Practice

INC 15 declaration from each company that submits the application

INC 16 license to found a company as section 8

INC 22 For registered office

DIR 2 Approval to act as director

DIR 3 Application to the Registrar of Companies (ROC) to obtain the DIN (Director Identification Number)

DIR 12 appointment of directors

Section 8 Business Registration Process

Step 1: Get DSC and file form DIR-3

The first step in establishing a Section 8 NGO in India is to obtain a DSC (Digital Signature Certificate) from the company’s proposed directors. After receiving the DSC, you must submit Form DIR-3 to the Registrar of Companies and request a DIN (Director Identification Number).

For DIN, you must include documents such as proof of identity and address.

Step 2: DIN from ROC

Step 3: INC-1 / RUN file to approve the company name

The next step is to submit the INC-1 / RUN form for approval of the company name to the ROC. You must propose a total of two names in the order of your choice.

Step 4: file format INC-12 with the ROC

Once your company’s name has been approved, you must submit Form INC-12 to the ROC. Form INC-12 is an application for a license to operate the Company per Section 8.

The documents you would need to attach with INC-12 include:

According to Form INC-13, Memorandum of Association (MOA);

Articles of Association (AOA);

Form INC-14, Declaration by the Practicing Public Accountant;

According to INC-15 declaration of each applicant;

Valued expenses and earnings for the next three years.

The company’s MOA and AOA subscription pages must include each subscriber’s signature. Also, it must include your name, address, and profession. Subscribers must sign the document in the presence of at least one witness who must confirm the signature and add their name, address, and profession, as well as their signature.

Step 5: Issue the license

Step 6: File the SPICe form INC-32 with the ROC

After you receive the license, you must submit SPICe INC-32 to the Registrar of Companies for business creation. You must enclose the following documents as well:

Under INC-9, an affidavit from each director and subscriber;

KYC of every director;

Declaration on deposits;

Letter of approval from each director;

Form DIR-2 with proof of identity and address of the directors;

Electricity bills as proof of address for an office that cannot be older than two months;

NOC if the office is rented or rented;

Interest in other companies of all directors;

Draft of MOA and AOA.

When the ROC determines that the form meets each criterion, it issues a COI (Certification of Incorporation) along with a unique CIN (Corporate Identity Number).

Benefits of Section 8 Company Registration

No minimum capital requirement

For Section 8 companies, there are no mandatory minimum capital requirements for the registration of public companies and others. At any stage, however, the capital structure required to grow the company can change. Also, direct funds and donations could be made to the Section 8 company.

Tax exemptions

Because Section 8 companies are a form of a non-profit organization, they can receive multiple tax exemptions, particularly the donors who contribute to such companies. Therefore, under section 80G of the 1961 Income Tax Act, donors can claim the tax benefit against the donation they made to the company.

Separate legal entity

A Section 8 company, like other companies, is an independent legal person and differs from its members. The company also exists in the long term.

Exempt from paying stamp duty

Section 8 companies have exceptions to the payment of the stamp duty required for the establishment, as is the case with other companies such as private and public companies.

Transfer of ownership is easy

Unlike other business units, the transfer of ownership or ownership is easily transferable. Also, the shares and shares of other members of the Company are considered movable property and are easy to transfer. As a result, it is easy for company members to leave the property and transfer it to others.

Use of the title

Unlike other companies such as limited liability companies and stock corporations, LLP, etc., where it is ultimately essential to use the title “limited liability company” or “LLP”, Section 8 companies are prohibited from using the Title exempt. Also, such companies can continue to do business without informing the public of their limited liability status. However, you need to add a suffix such as foundations, associations, etc.

Credible

Such companies are more credible than other non-profit organizations, be it a company or a trust. Since licensing is done by the central government, the rules are strict compared to other companies. Changes in MOA (Memorandum of Association) and AOA (Statutes) are therefore not possible at any time or at any time. Section 8 companies are therefore more reliable and credible than others.

The penalty under section 8 company

If a company fails to comply with the provisions and provisions of section 8, the company will be subject to fraudulent acts and punishable under the provisions of section 8 subsection (11) of the Companies Act 2013. The company would also have to pay:

A fine of Rs. 10 lakhs that could extend to Rs. 1 crore.

Every director and the defaulting executive of the company are punishable. They would also be jailed for no less than Rs three years. 25,000. However, this fine could extend to Rs. 25 lakh.

Or the guilty must serve both.

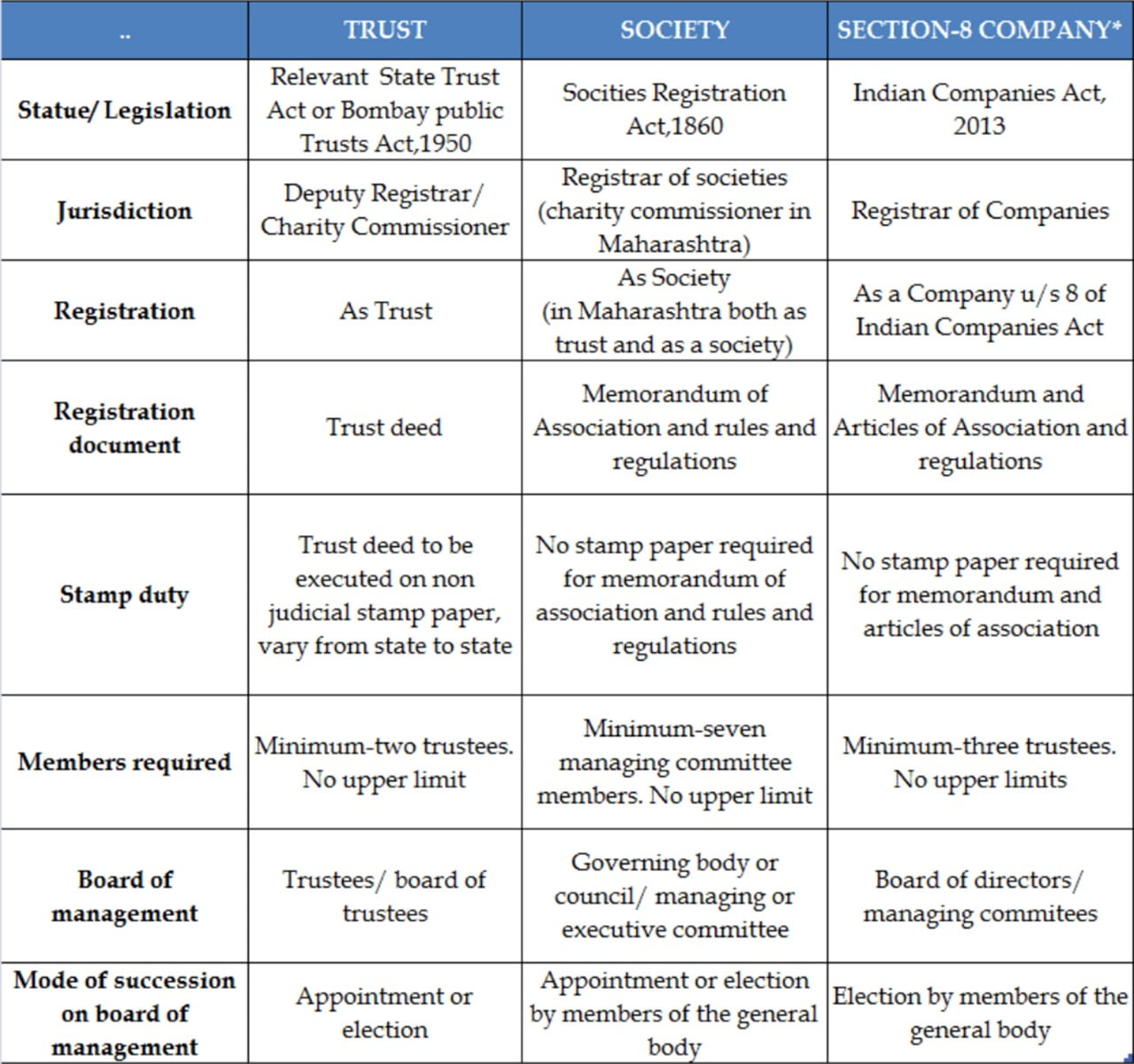

The table below will help you to compare Trust/Society/Section 8 company:

The comparison above shows that a Section 8 company is one of the best ways to run a nonprofit organization while choosing between Trust/Society/Section 8 company. However, it has high registration and maintenance costs and takes a long time to integrate. Trust and societies are effective structures from an economic point of view. Trusts are easy to create and maintain and are therefore very popular.

Frequently Asked Questions

Where do I go to register my NGO ( Trust/Society/Section 8 company )?

Trusts are usually registered with the sub-registrar of the area in which you want to work. This is the same place where the purchase and sale of land/real estate are registered. Companies are registered in the office of the registrar of companies in your region. For more information, contact your local sub-registrar / tehsildar office.

Can a trustee receive a salary from their Trust/Society/Section 8 company?

You can’t take money for just being a trustee in a nonprofit. However, if you work for the same, you can get reasonable compensation, which means that it would be illegal to make more money than market prices.

Click here to know about a Nidhi Company.