Key Income Tax Changes from April 2025: What Every Taxpayer Should Know

The Indian government’s Union Budget 2025 introduced a range of significant amendments to the Income Tax Act, 1961, aimed at simplifying the tax system and enhancing financial planning. These changes, effective April 1, 2025, will shape tax liabilities for the financial year (FY) 2025-26 and assessment year (AY) 2026-27. Here’s an overview of the most important updates that every taxpayer needs to know to navigate the new financial landscape.

1. Revised Income Tax Slabs under the New Tax Regime

The new tax regime will become the default system, featuring revised slabs to increase savings and spending capacity.

The old tax regime remains optional with no changes in its slab rates.

Enhanced Rebate Under Section 87A

One of the most notable changes is the increased rebate under Section 87A. Taxpayers under the new regime can now claim a rebate of up to ₹60,000, compared to the previous ₹25,000. This effectively means individuals with taxable income up to ₹12,00,000 will have zero tax liability after availing of this rebate.

The rebate for the old tax regime remains capped at ₹12,500.

Standard Deduction Benefits Continue

For salaried employees, the standard deduction of ₹75,000 remains a significant relief under the new tax regime. Combining this deduction with the enhanced rebate under Section 87A, individuals can earn up to ₹12.75 lakh without paying any income tax.

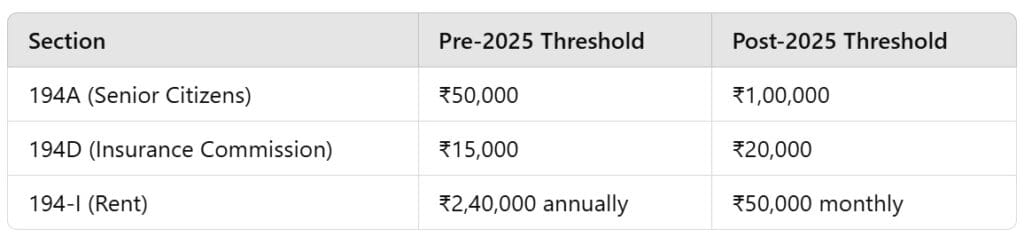

Updated TDS (Tax Deducted at Source) Thresholds

TDS provisions have been revised to reduce compliance and increase limits. Notable changes include:

Other sections, such as those for interest on securities and brokerage, have also seen increased threshold

Changes to Tax Collected at Source (TCS)

TCS thresholds have been relaxed for specific transactions:

- LRS for education loans: TCS is now NIL for amounts financed through loans.

- Purchase of goods: TCS has been removed for transactions over ₹50 lakh.

Extended Timeline for Filing Updated Tax Returns (ITR-U)

Taxpayers now have up to 48 months (4 years) to file updated tax returns, allowing more time to disclose undisclosed incomes. Additional tax liability percentages have been set based on the time of filing, ranging from 25% to 70%.

Tax Benefits for Startups and IFSC Units

Startups: Businesses incorporated before April 1, 2030, can claim a 100% deduction on profits for three consecutive years out of the first ten years of incorporation under Section 80-IAC.

IFSC Units: The deadline for tax concessions for International Financial Services Centre (IFSC) operations has been extended to March 31, 2030.

Relaxation for House Property Income

The annual value of up to two self-occupied properties can now be declared NIL, even if the owner cannot occupy them due to personal reasons.

Deduction on Partner Remuneration

Partnership firms and LLPs can now claim higher deductions for remuneration paid to partners, with updated calculation limits to allow greater deductions.

Taxation on ULIPs as Capital Gains

Proceeds from Unit Linked Insurance Plans (ULIPs) with premiums exceeding 10% of the assured amount or ₹2.5 lakh annually will now be treated as capital gains.

Simplification Through Omission of Sections 206AB and 206CCA

To reduce compliance burdens, Sections 206AB and 206CCA have been omitted, removing complexities related to determining withholding tax rates for non-filers.

Conclusion

The 2025 income tax changes aim to streamline taxation, increase compliance, and promote financial growth. These reforms are essential for individuals, startups, and businesses to optimize their tax liabilities effectively.

How BusinessRights Can Help

At BusinessRights, we assist businesses and individuals in navigating the complexities of tax compliance and financial management. Our team of experts is here to help you understand the latest income tax changes, assess their impact, and plan your finances effectively.

Need assistance with tax filing, financial planning, or compliance management? Get in touch with BusinessRights today and simplify your tax journey!

Stay informed, stay compliant. Your success is our priority!